Here Are Some Key Points To Understand About Medicare Supplement Plans

Complementary Coverage:

Medicare Supplement Plans are not standalone insurance plans; they are meant to complement Original Medicare. They help fill in the gaps in Medicare coverage by paying for some or all of the expenses that Medicare does not cover.

Standardized Plans:

Medicare Supplement Plans are standardized by the federal government, which means they must offer the same basic benefits of Original Medicare, regardless of the insurance company that sells them. This standardization makes it easier for beneficiaries to compare plans.

Plan Types:

There are several standardized Medicare Supplement Plans, labeled with letters (A, B, C, D, F, G, K, L, M and N). Each plan type offers a specific set of benefits, although not all plans are available in every state.

No Network restrictions/Referrals:

Unlike Medicare Advantage Plans, Medicare Supplement Plans do not have provider networks. Beneficiaries can see any doctor or healthcare provider in the United States that accepts Medicare patients. There are no referrals required to see a specialist.

Guaranteed Issue Rights:

There are certain times when you have guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge you higher premiums due to pre-existing health conditions. For example, if you enroll in a Medigap plan during your Initial Enrollment Period (IEP), which begins when you are 65 or older and enrolled in Medicare Part B, you have guaranteed issue rights.

No prescription Drug Coverage:

Medicare Supplement Plans do not include prescription drug coverage (Medicare Part D). If you want prescription drug coverage, a separate stand-alone prescription drug plan will need to be purchased.

Renewable Coverage:

Generally, as long as you pay your premiums on time, your Medicare Supplement Plan is guaranteed to be renewable. Insurance companies cannot cancel your coverage due to health changes or use underwriting to deny coverage renewal.

Medicare Advantage Plans Michigan

Medicare Advantage Plans, often referred to as “Medicare Part C,” are a type of health insurance option offered to individuals who are eligible for Original Medicare, which is the federal health insurance program primarily for people aged 65 and older, as well as some younger individuals with certain disabilities. Medicare Advantage Plans are provided by private insurance companies that been approved by Centers for Medicare and Medicaid Services (CMS).

Here Are Some Key Points To Understand About Medicare Advantage Plans

All in one Coverage:

Medicare Advantage Plans are designed to provide comprehensive health coverage by bundling together the benefits of Medicare Part A (hospital insurance) and Part B (medical insurance). Many Medicare Advantage Plans also include prescription drug coverage (Medicare Part D) as part of their package.

Network-Based Care:

Most Medicare Advantage Plans operate within a network of healthcare providers, such as doctors, hospitals, and specialists. You may need to choose healthcare providers within the plans network to receive the maximum benefits. Some plans offer out of network coverage, but at higher costs.

Part A and Part B:

People interested in Medicare Advantage plans must first sign up for both Part A and Part B of Medicare and pay the Part B monthly premium, for 2024 that cost is $174.70. Part B premiums may change annually.

Premiums and Costs Sharing:

Enrollees in Medicare Advantage Plans typically do not pay a monthly premium. Medicare Advantage Plans typically pay only 80% of covered medical costs. Generally speaking, enrollees should expect to pay copayments, deductibles, and coinsurance, which can vary depending on the services received.

Additional benefits:

Medicare Advance Plans often include additional benefits that are not covered by Original Medicare, such as dental care, vision services, hearing aids and wellness programs. These extra benefits can vary from one plan to another.

Prescription Drug Plans:

Many Medicare Advantage Plans include prescription drug coverage (Part D) as part of their benefits. If you enroll in a plan that does not include Part D coverage, you may need to purchase a separate standalone Medicare Part D plan to cover your prescription costs.

How Original Medicare Works

Disclaimer: The following is a summary of Medicare benefits, and is subject to change.

For more complete information, please visit Medicare.gov. or call 1-800-633-4227

Medicare is a federal health insurance program in the United States that primarily serves individuals aged 65 and older, as well as some younger individuals with certain disabilities. It's important to understand the basics of Medicare, as it plays a significant role in healthcare coverage for millions of Americans. Here's a Medicare 101 overview:

Medicare Parts A, B, C, and D:

Medicare is divided into several parts, each covering different aspects of healthcare:

Medicare Part D

Here are the key points to understand about Medicare Part D:

Voluntary Prescription Drug Coverage:

Medicare Part D is a voluntary program. It allows Medicare beneficiaries to enroll in a standalone prescription drug plan (PDP) or choose a Medicare Advantage Plan (Part C) that includes prescription rug coverage as part of its benefits. Part D plans are offered by private insurance companies that are approved by CMS.

Coverage for Prescription Drugs:

Medicare Part D provides coverage for a wide range of prescription drugs, including brand-name and generic medications. Covered drugs are typically divided into different tiers, with different cost-sharing levels. Generic drugs often have lower copayments or coinsurance than brand-name drugs.

Monthly Premiums

Medicare Part D plans charge a monthly premium, which can vary depending on the plan you choose. Beneficiaries are responsible for paying this premium in addition to their regular Medicare Part B premium.

Annual Deductibles:

Most Part D plans have an annual deductible, which is the amount you must pay out of pocket before your plan begins to cover your medications. Not all plans have a deductible, and the amount can vary from one plan to another.

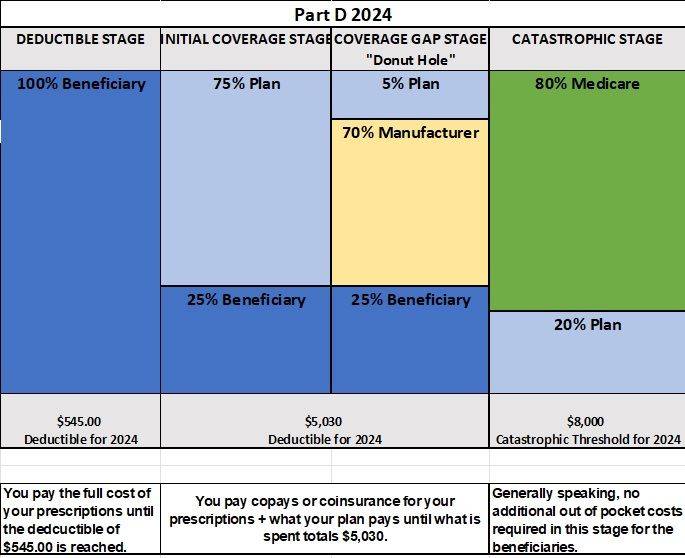

Medicare Part D includes a coverage gap, often referred to as the "donut hole." After you and your plan have spent a certain amount on covered drugs in a calendar year, you enter the coverage gap. During this phase, you may be responsible for a higher percentage of the cost of your medications.

Catastrophic Coverage:

After you spend a certain amount out of pocket for covered drugs in a calendar year, you enter the catastrophic coverage phase. During this phase, you'll pay a significantly reduced amount for your prescription drugs for the remainder of the year.

Formularies:

Each Part D plan maintains a list of covered medications called a formulary. The formulary may change from year to year, so it's essential to review your plan's formulary annually to ensure that your medications are covered. If a drug is not on your plan's formulary, you may need to pay the full cost or consider alternatives.

Enrollment Periods:

You can enroll in a Medicare Part D plan during specific enrollment periods, such as the Initial Enrollment Period (when you first become eligible for Medicare), and Annual Enrollment Period (AEP), and Special Enrollment Periods (SEPs) in certain circumstances.

Extra Help:

Some low-income individuals may qualify for Extra Help, a program that helps pay for Part D premiums, deductibles, and drug costs. Eligibility for this program is based on income and resources.

Medicare Part D is an important component of Medicare, as it helps beneficiaries access necessary prescription medications while managing their out-of-pocket costs. It's crucial to review and compare the available Part D plans in your area each year during the Annual Enrollment Period to ensure that you have the coverage that best meets your prescription drug needs.

Medicare Penalties & Other Useful Information

Medicare penalties can be incurred if individuals do not enroll in certain parts of Medicare when they are eligible or if they delay enrollment.

Here's a summary of common Medicare penalties:

It's crucial to understand the specific enrollment periods and requirements for each part of Medicare to avoid potential penalties. If you're unsure about your Medicare eligibility or enrollment options, consider consulting with a Medicare counselor or contacting the Social Security Administration for guidance. Proper enrollment and timely decision-making can help you avoid unnecessary penalties and ensure you have comprehensive Medicare coverage when you need it.

Contact Us

"*" indicates required fields